Safe Banking

Keep Online Banking Simple and Safe

Safe Banking

Keep Online Banking Simple and Safe

How to Bank Safely?

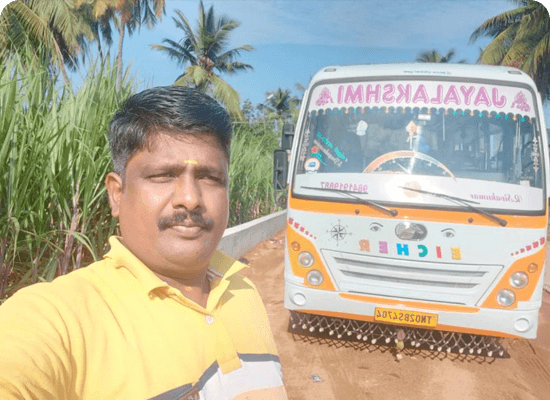

Why Choose Equitas for Safe Banking?

Proactive Protection: We stay ahead of threats to keep your accounts safe.

Customer Empowerment: We equip you with the knowledge to make your banking secure.

Constant Vigilance: Continuous monitoring to guard you against fraud and cyber threats.

Tips for Safe Banking

Stay Informed: Keep abreast of the latest security advisories and practices.

Protect Your Information: Never share your banking credentials with anyone.

Regular Updates: Keep your banking apps and software up to date.

Blogs